You’ve almost certainly heard of the UK’s £3,000 annual Inheritance Tax (IHT) exemption. It’s a simple, well-known tool. But what about its far more powerful, and often misunderstood, sibling: the 'normal expenditure out of income' exemption? If you've ever wondered how to pass on wealth regularly without starting the dreaded 7-year clock, this is one of the most important concepts in estate planning.

Picture this: A retired couple in Surrey has a comfortable pension and investment income. They’ve already used their £3,000 annual exemptions by gifting to their children. Now, they want to help their grandchild by paying their £400 monthly nursery fees. They worry this will be classed as a 'Potentially Exempt Transfer' (PET), a gift that could be subject to IHT if they don't live for another 7 years. But if this payment is structured correctly, it could be 100% IHT-free from the day it's made. The key isn't *how much* they give, but *how* they give it.

Key Takeaways

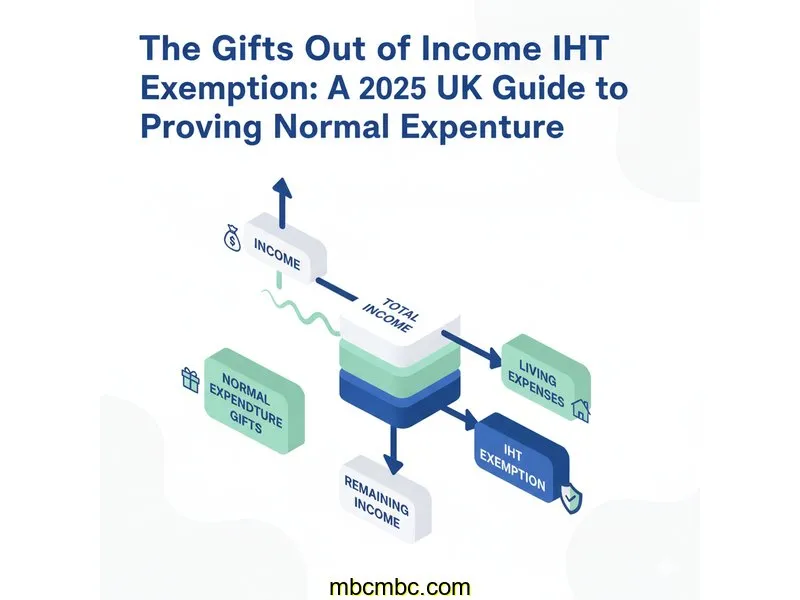

- The Core Rule: Gifts made from your *surplus income* (not savings) that are part of a regular pattern and don't reduce your standard of living are immediately exempt from Inheritance Tax.

- The Unlimited Potential: Unlike the £3,000 annual exemption, this exemption is *unlimited in value*. You could theoretically give away £30,000 a year this way, provided you can prove it's from surplus income.

- The "Proof" Is Everything: This exemption is not automatic. It must be proven to HMRC by your executor after your death, making meticulous record-keeping essential.

- Key Data Point: With the average IHT bill for paying estates sitting at £214,000 (HMRC, 2020/21 data), using all available exemptions is a critical part of estate planning.

- Disclaimer: This article provides informational guidance on HMRC rules as of November 2025. It is not financial or tax advice. IHT planning is complex and personal—you should always consult a qualified solicitor or chartered tax advisor for your specific situation.

Why This Exemption Exists: Income vs. Capital

Inheritance Tax is, at its core, a tax on your **capital**—the assets you’ve accumulated over your lifetime, such as your house, savings, and investments. The basic IHT threshold (Nil-Rate Band) has been frozen at £325,000 since 2009 and is set to remain there until at least April 2028 (UK Government, 2024). This freeze, combined with rising asset values, means more families are being pulled into the IHT net.

HMRC's gifting rules are designed to stop people from giving away all their *capital* on their deathbed to avoid tax. This is why the 7-year rule for Potentially Exempt Transfers (PETs) exists. If you give away capital and die within 7 years, it’s pulled back into your estate for IHT calculations.

The 'normal expenditure out of income' exemption is different. It exists to allow you to be generous with your *income* during your lifetime without penalty. Let's use an analogy:

Think of your finances as a bathtub. The water in the tub is your **capital** (savings, property). The water flowing from the tap is your **income** (pension, salary, dividends). Your daily living costs are the water going down the drain.

If you scoop a large bucket of water out of the tub and give it away (a PET), HMRC starts the 7-year timer. But if your tap flows faster than your drain, the tub will overflow. This *overflow* is your surplus income. The 'normal expenditure' rule allows you to give this overflow away, immediately IHT-free, because you're not depleting the capital value of the water already in the tub.

This distinction is crucial. You aren't reducing your estate's capital; you are simply spending your income as you earn it—in this case, by gifting it.

The Three-Pronged Test: How HMRC Defines "Normal Expenditure"

This exemption is generous, but it's not a free-for-all. To qualify, your executor must be able to prove to HMRC that the gifts met three specific conditions, as laid out in HMRC's IHT403 guidance (HMRC, 2024).

Test 1: It Must Be Made From Income

This is the most fundamental rule. The gift must be made from your post-tax income, not your capital. If you have to sell investments, dip into your savings account, or use a cash ISA to fund the gift, it will *not* qualify. You must be able to show that your income (e.g., pension, employment, dividends, rental profit) exceeded all your living expenses, and the gift was paid from that surplus.

Test 2: It Must Be Part of a "Normal" Pattern

"Normal" means habitual or regular. A one-off, spontaneous large gift is unlikely to qualify. This doesn't mean it must be the exact same amount paid every month. A pattern could be:

- Paying £300 every month for a grandchild's school fees.

- Gifting £1,000 every Christmas to each of your children.

- Paying an annual £5,000 university accommodation bill every September.

The key is establishing a pattern of giving. This is why it's so important to start the payments and document your intention early.

Test 3: You Must Maintain Your Normal Standard of Living

After making the gift, you must be left with enough income to maintain your usual lifestyle. You cannot claim the exemption if you're giving away £500 a month but then find yourself unable to afford your annual holiday, run your car, or pay your bills. The gifts must come from income that is genuinely *surplus* to your needs.

Gifting Allowances Compared: The "Unlimited" Exemption vs. The Rest

The confusion for many people is how this rule interacts with other gifting allowances. Let's break it down.

| Gifting Method | Value Limit | The "7-Year Clock" | Key Requirement | Best For... |

|---|---|---|---|---|

| Annual Exemption | £3,000 per tax year | No clock (immediately exempt) | You just have to make the gift. Can be from income or capital. | Simple, flexible annual gifts to children or for general estate reduction. |

| Small Gifts Exemption | £250 per person, per year | No clock (immediately exempt) | Cannot be used on anyone who *also* received part of your £3,000 annual exemption. | Small birthday or Christmas presents to multiple people (e.g., grandchildren, nieces). |

| Potentially Exempt Transfer (PET) | Unlimited | Yes, starts the 7-year clock. | You must survive for 7 years after the gift for it to become 100% IHT-free. | Large, one-off capital gifts, like a house deposit or lump sum of cash. |

| Normal Expenditure from Income | Unlimited | No clock (immediately exempt) | Must pass all three HMRC tests (from income, regular pattern, maintains lifestyle). | Regular, ongoing support like paying school fees, care home top-ups, or monthly allowances. |

As the table shows, the 'Normal Expenditure' exemption is in a class of its own. You can use it *in addition* to your £3,000 annual exemption. For example, you could give your son a £3,000 lump sum (Annual Exemption) and *also* pay his £200-a-month car finance (Normal Expenditure), and neither would start the 7-year clock.

How to Prove It: The Record-Keeping Imperative

This is the most critical part of the process. This exemption is claimed by your executor on form IHT403 after your death, and HMRC *will* ask for proof. If the records aren't there, the exemption will be denied, and all those gifts could be added back into your estate for tax purposes.

You need to create an evidence file for your executor. Here’s a step-by-step guide to what that file should contain.

Step 1: Write a "Statement of Intent"

To establish a "pattern," it's wise to document your intention from the start. This can be a simple, signed letter kept with your will.

Consider this scenario: You decide to pay your grandchild's £1,000-per-term music lessons. You should write a letter stating: "I, [Your Name], on this date [Date], intend to pay for my grandchild [Name]'s music lessons, up to the value of approximately £3,000 per year, for as long as they are in school. I am making these payments from my surplus pension income, and they do not affect my normal standard of living."

Step 2: Create a Simple Income vs. Expenditure Ledger

The best proof is a simple spreadsheet, updated annually. This ledger should show:

- Total Annual Income: List all sources (State Pension, private pension, employment, dividends, interest, rental income, etc.).

- Total Annual Expenditure: List all your typical costs (mortgage/rent, council tax, utilities, food, transport, holidays, insurance, hobbies).

- The Result: `Total Income - Total Expenditure = Surplus Income`

As long as the total value of your gifts is *less* than your calculated 'Surplus Income', your executor has powerful evidence.

Step 3: Keep 7 Years of Bank Statements

Your ledger shows the calculation, but bank statements prove it. Keep copies (digital or paper) of your main bank accounts. These statements will show the income arriving each month and the regular gifts going out, demonstrating that you weren't dipping into your capital (savings) to fund them.

Common Questions About Gifts From Income

Based on questions I've seen on forums like Reddit's r/UKPersonalFinance and Mumsnet, here are the most common points of confusion.

1. What records do I really need to prove 'normal expenditure' to HMRC?

At a minimum, your executor will need a summary of your income and expenditure for at least the last 7 years of your life, along with your bank statements to back it up. The 'Statement of Intent' is highly recommended to prove the gift was 'normal' and 'habitual'. Without these records, HMRC is likely to deny the claim.

2. Can I use the £3,000 annual exemption AND the normal expenditure exemption in the same year?

Yes. They are entirely separate exemptions. You can absolutely give someone a £3,000 gift (from income or capital) to use your Annual Exemption, and *also* give them regular gifts from your surplus income under the 'Normal Expenditure' rule. One does not affect the other, which is what makes this combination so powerful.

3. Does 'normal expenditure' have to be the same amount every month?

No. 'Normal' or 'regular' refers to the pattern, not necessarily the amount. Paying an annual school fee that increases slightly each year would qualify. Giving regular birthday and Christmas gifts of varying amounts would also qualify, as the *pattern* of giving is established. The key is that it's a recurring gift, not a one-off, and that it always comes from surplus income.

Conclusion: Your Next Steps

The 'normal expenditure out of income' exemption is arguably the most powerful tool in the IHT planning box, precisely because it is unlimited and takes effect immediately. It transforms regular, everyday generosity into a highly effective way of passing on wealth without incurring tax.

However, it is not a "set it and forget it" tool. The exemption is earned through diligence. If you believe you have surplus income and wish to start a pattern of regular gifting, your next steps should be to create the simple record-keeping system outlined above. A simple spreadsheet and a signed letter, kept with your will, could end up saving your estate tens of thousands of pounds. Given the complexity and the high stakes, IHT planning is one area where seeking professional advice from a qualified solicitor or tax advisor is essential to ensure your intentions are clear and your records are compliant.