Auto Loan Calculator

Calculate payments over the life of your Loan

Home Blog Privacy Terms About Contact

Calculate payments over the life of your Loan

Home Blog Privacy Terms About ContactPublished on October 15, 2025

My journey into the world of loan calculations started with a simple conversation. A friend mentioned their recent loan, and when they told me their monthly payment, I was genuinely surprised. It seemed so low for the amount they borrowed. My immediate thought was, "Wow, they got a great deal!" But then they added a detail that didn't quite compute: they'd be paying it off for a very long time. This created a question in my mind that I just couldn't shake: how could a lower monthly payment not automatically mean a better arrangement?

It felt like a paradox. In my head, a lower number was always better. A smaller bill each month meant more money in my pocket, right? Yet, something about my friend's seven-year timeline felt... expensive. I realized I had always focused on the monthly payment figure because it's the number you feel most directly. It’s the amount that leaves your bank account. But what was I missing? What was the hidden story behind that number?

This curiosity sent me down a rabbit hole of online loan calculators. I wasn't looking to borrow money; I just wanted to understand the mechanics. My goal was simple: I wanted to see for myself how changing one number—the loan term—could ripple through all the other numbers in a loan. I wanted to solve the puzzle of how a smaller payment could exist alongside a larger overall expense. This is simply my personal journey of discovery. It's about understanding how calculations work, not financial advice.

I started plugging in hypothetical numbers, just playing around with the tools. At first, it was just a series of inputs and outputs. But soon, patterns began to emerge, and the numbers started telling a story I hadn't known how to read before. The relationship between time, payments, and the total figure owed was far more interesting than I ever imagined.

My first real experiment started with a made-up scenario. I decided to use a loan amount of $16,850 with a hypothetical interest rate of 7.1%. I opened a standard loan calculator online, ready to see the math in action. My first instinct was to see what a fairly standard four-year term would look like. I typed in "48 months."

The calculator instantly returned a monthly payment: $403.95. Okay, that was my baseline. I saw other numbers on the screen, like "Total Interest Paid" and "Total of Payments," but my eyes were glued to that monthly figure. It was the only thing that felt tangible to me at the time.

Then, I decided to test my friend's situation. What if I stretched the timeline? I changed the term from 48 months to 72 months—a six-year term. I clicked "Calculate," and the new number appeared: $287.97. My first reaction was a jolt of excitement. That was a difference of over $115 every single month! It felt like a massive improvement. My brain immediately concluded that the longer term was the "smarter" option because it freed up so much cash flow.

But then, my curiosity pushed me to look at the other fields I had been ignoring. Next to the 48-month scenario, the "Total Interest Paid" was $2,539.60. For the 72-month scenario, that same field showed a staggering $3,883.84. I stared at the screen, completely baffled. The monthly payment was significantly lower, but the total interest was over $1,344 higher. It didn't make sense. How could I pay less each month but more overall? The two scenarios felt disconnected, like they were from different financial universes. It was the first time I realized that the monthly payment and the total expense were telling two completely different stories.

That disconnect was the key. I spent a while just toggling the loan term back and forth between 48 and 72 months, watching the monthly payment and total interest figures dance in opposite directions. The lower the payment went, the higher the interest climbed. It was this inverse relationship that I needed to understand. The frustration of not seeing the connection drove me to dig deeper into what the calculator was actually doing behind the scenes.

My breakthrough came when I stopped thinking about interest as a single, fixed fee. I had been subconsciously imagining it as a percentage tacked on at the beginning. The reality, I learned, is that interest is calculated continuously on the remaining balance. A longer loan term doesn't change the interest rate, but it dramatically changes the amount of time that rate has to work against you. With a longer term, the principal balance decreases much more slowly. This means you're paying interest on a larger amount of money for a longer period, allowing much more interest to accumulate over the life of the loan.

My next step was understanding how that monthly interest was calculated. I learned that you take the annual interest rate (like my 7.1%), convert it to a decimal (0.071), and then divide by 12 to get a monthly rate. For my scenario, that's roughly 0.005917. For the first month, you multiply this by the full loan balance of $16,850. This gives you about $99.69 in interest for the very first payment.

This was the real "aha" moment. With the 72-month loan, my first payment of $287.97 would have about $99.69 going to interest. That means only $188.28 actually went to reducing the $16,850 I owed. In the 48-month scenario, the first payment of $403.95 would also have $99.69 in interest, but a much larger $304.26 would go toward the principal. I finally saw it clearly: the shorter-term loan attacked the principal balance much more aggressively from the very beginning.

This aggressive principal reduction is why the shorter-term loan costs less overall. By paying down the principal faster, the balance on which future interest is calculated shrinks more quickly. With the longer term, the balance stays higher for many more months, giving that 7.1% rate more to "feed on." It was a powerful visual: time was literally money.

To make sure I really got it, I ran a completely different scenario. I imagined a loan for $11,300 at an 8.4% interest rate. First, I set the term to 36 months (3 years). The calculator showed a payment of around $354.55 and total interest of $1,463.80. Then, I stretched the term to 60 months (5 years). The payment dropped to $230.13, but the total interest jumped to $2,507.80. The pattern held. The lower payment came at the cost of over $1,000 in additional interest. My understanding was confirmed.

This entire process was a huge learning experience for me. I went from being confused by a simple conversation to truly grasping the mechanics behind the numbers on a calculator. It wasn't about finding a "right" or "wrong" answer, but about understanding the trade-offs that the math reveals. Here are the key things I now understand about the calculations:

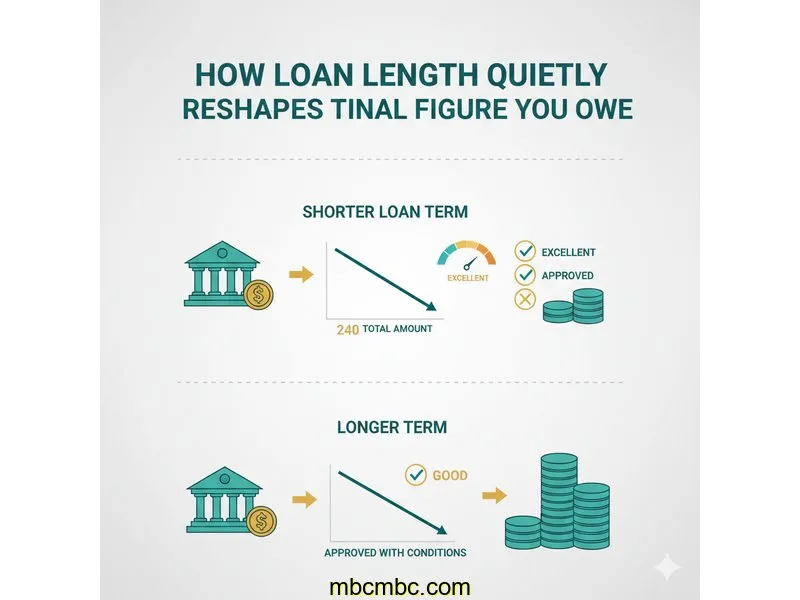

The loan term dictates the number of months interest will be calculated on your outstanding balance. A longer term means the principal amount decreases more slowly, so you pay interest on a higher average balance for a greater number of months. This allows more total interest to accumulate over the life of the loan, even if the interest rate is identical to a shorter-term loan.

That would be a simple interest calculation. Most personal loans use an amortizing calculation, where interest is charged on the declining balance. As you make payments and reduce the principal, the amount of interest you're charged each month also decreases. The "Total Interest Paid" is the sum of all these monthly interest charges over the entire term.

Yes, this is exactly what an amortization schedule shows. Most good online loan calculators have a feature to "Show Amortization Schedule" or "View Payment Breakdown." This table will list every single payment for the entire loan term, breaking down precisely how many dollars and cents go toward interest and how many go toward reducing your principal balance.

From a purely educational standpoint of understanding the cost, the "Total Interest Paid" is arguably the most revealing number, as it shows the true expense of borrowing the money. The "Monthly Payment" is crucial for understanding the loan's impact on your monthly budget. Neither is more "important" than the other; they just tell different parts of the financial story, and understanding both is key to calculation literacy.

My biggest takeaway from this journey is that time is one of the most powerful—and often underestimated—variables in financial calculations. I used to think of a loan term as just a simple divisor, a way to chop a big number into small, manageable pieces. Now, I see it as a multiplier for interest. Understanding that single concept has fundamentally changed how I look at loan calculators and the stories their numbers tell.

It's empowering to know how to manipulate the inputs in a calculator not to find the "best" loan, but to understand the relationship between the numbers. Seeing how a small change in the term can lead to a thousand-dollar difference in total interest is a lesson that sticks with you. It transforms the calculator from a simple answer machine into a genuine learning tool.

I encourage anyone who feels intimidated by these numbers to simply open a calculator and start playing. You don't need a real-world scenario; just invent one. Change the rate, change the term, change the loan amount, and watch what happens. That curiosity is the first step toward building a real, practical understanding of how this math works for you. This article is about understanding calculations and using tools. For financial decisions, always consult a qualified financial professional.

Disclaimer: This article documents my personal journey learning about loan calculations and how to use financial calculators. This is educational content about understanding math and using tools—not financial advice. Actual loan terms, rates, and costs vary based on individual circumstances, creditworthiness, and lender policies. Calculator results are estimates for educational purposes. Always verify calculations with your lender and consult a qualified financial advisor before making any financial decisions.